2023 Annual Financial Market Review

By Zone Financial | 18 January 2024

A better year for investors

Financial Market Performance

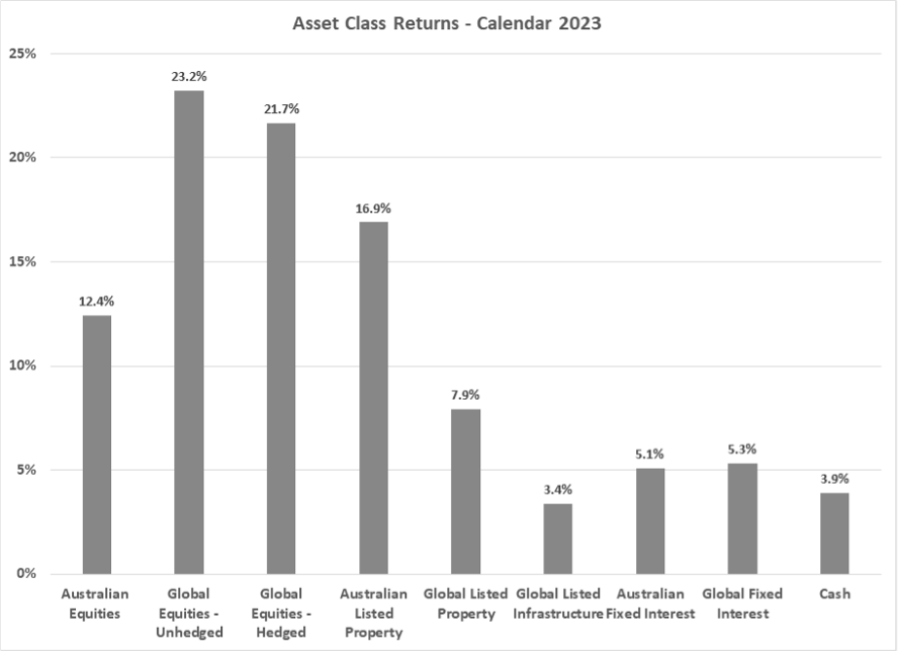

The 2023 calendar year was also one full of activity and surprises for financial markets. Most notable was the resiliency shown by the United States economy, with growth remaining robust and defying the rapid increase in interest rates. Widespread forecasts of recession did not eventuate, despite the additional challenges presented by the collapse of some large U.S. banks and the tragic events that unfolded in the Middle East. Not only did the U.S. economy continue to expand, but policy makers also achieved their desired outcome for inflation, which fell and steadily approached target in the latter half of the year. This “goldilocks” soft landing scenario was accompanied by growing evidence that artificial intelligence was ready to transform business models and provide new sources of revenue and productivity growth. Global share markets rallied strongly as a result, with the 21.7% annual gain being above the most optimistic of expectations held at the start of the year. The 62.3% price surge in the large U.S. Information Technology sector was particularly notable.

Although the Australian share market under performed, the 12.4% increase in the ASX S&P 200 Index was significant – particularly given that the 2022 fall in Australian market was limited to 1.1% (whereas global equities had a much larger correction in the previous year of 18.1%). Australia’s lower exposure to the burgeoning Information Technology was one source of relative underperformance from the local market in 2023. Falling oil and energy prices were also a negative influence, however a surprising increase in the iron ore price led to gains being recorded by the large mining companies. A 19% jump in iron prices belied the significant weakness experienced in the Chinese economy and also provided a source of support for the Australian currency, which finished the year stronger by 1.0% against the $US at U.S. 68.4 cents.

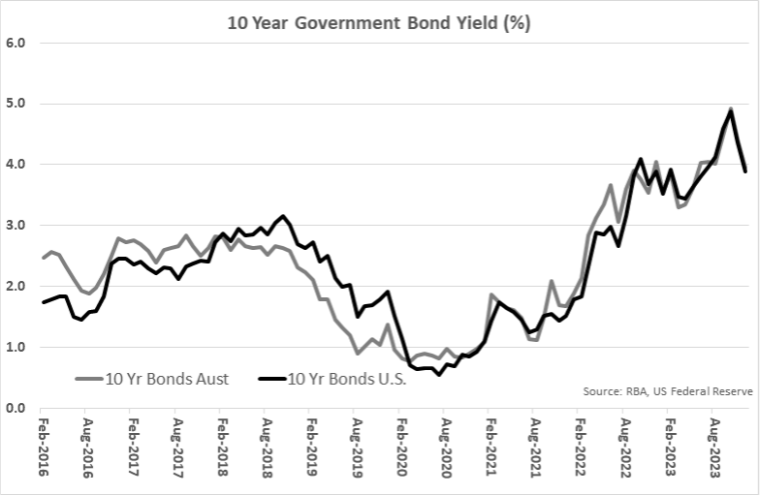

Last year was also notable for the unusually high level of volatility on bond markets. With the market underestimating the strength of the economy, there was also an underestimation of the magnitude of monetary policy tightening that could be accommodated. Traditional economic theory then suggested that if the economy was strong, interest rates would have to remain high for an extended period in order to control inflation. This resulted in bond yields rising sharply until early November, when there was a realisation that traditional theory was not holding, and inflation was rolling over despite the strength of the economy.

Yields then declined rapidly, producing significant capital gains for bond investors. This pattern was characteristic of most developed economy bond markets, including Australia, which were closely correlated to movements in the United States. Both the Australian and U.S. 10-year government bond yields commenced 2023 at around the 4% level and then rose sharply to approach 5% in late October. The subsequent easing of inflation concerns then resulted in yields declining by approximately 1% in the final 2 months of the year, with the Australian 10-year yield closing at 4.0% and the U.S. equivalent yielding 3.9%.

Both property and infrastructure showed high sensitivity to interest rates over 2023, with valuations falling over much of the year as interest rates increased; before a sharp recovery in the last 2 months when bond yields dropped. Australian listed property was the best performed of these real asset classes, with a gain of 16.9%. A 48% bounce in the industrial property specialist, Goodman Group, contributed significantly to this outperformance from Australian property.

Outlook and considerations for investors

The magnitude of the rally on equity markets over 2023, and more recently on bond markets, has presented a challenging environment for investors at the start of 2024. Valuations have already responded significantly to the promise of a “soft landing”, which has reduced the scope for further gains this year. The risk that a recessionary environment has been delayed, rather than avoided, cannot be ignored; nor can the risk that further declines in inflation prove much more difficult to achieve than they have over recent quarters.

For Australian investors, differences between the state of the Australian and U.S. economies need to be acknowledged. Although financial markets in both economies have enjoyed buoyant conditions of late, growth in the Australian economy is fundamentally weaker than that of the U.S. – whereas inflation is higher here. With Australian cash interest rates 1% below those of the U.S., there is arguably less scope for an easing in monetary policy in Australia, which could prove to be a source of disappointment for both bond and equity markets.

Notwithstanding the risks highlighted above, there is minimal evidence of dysfunction in financial markets or the broader global economy. Unemployment is generally low, wages growth contained and corporate balance sheets in strong health. With this backdrop, and the possibility of an eventual recovery in the Chinese economy, company earnings could drive share markets higher in the year ahead. The upcoming Presidential Election in the US, wars in Ukraine and the Middle East, and questions around interest rates, will also need to be taken into account when assessing portfolio positions.

The following indexes are used to report asset class performance: ASX S&P 200 Index, MSCI World Index ex Australia net AUD TR (composite of 50% hedged and 50% unhedged), FTSE EPRA/NAREIT Developed REITs Index Net TRI AUD Hedged, Bloomberg AusBond Composite 0 Yr Index, Barclays Global Aggregate ($A Hedged), Bloomberg AusBond Bank Bill Index, S&P ASX 300 A-REIT (Sector) TR Index AUD, S&P Global Infrastructure NR Index (AUD Hedged), CSI China Securities 300 TR in CN, Deutsche Borse DAX 30 Performance TR in EU. Hang Seng TR in HK, MSCI United Kingdom TR, Nikkei 225 in JP, S&P 500 TR in US.

You are receiving this communication as a client or associate of Zone Financial

Zone Financial Pty Ltd ABN 51 604 835 921, Drew Hickey and Damian Masi are Authorised Representatives of Zone Advisory Pty Limited ABN 93 661 797 879 Australian Financial Services Licence No. 544 310

This Market Update contains information that is general in nature. It does not constitute financial or investment advice. Any information, material or commentary is intended to provide general information only and does not take into account personal circumstances. Zone Financial Pty Ltd makes no representation as to the accuracy or completeness of the information. Before acting on any information contained in this document, each person should consider its appropriateness having regard to their own or their clients’ individual objectives, financial situation and needs. You should obtain independent taxation, financial and legal advice relating to this information and consider it carefully before making any decision or recommendation.

Further reading

Zone Financial

We are a strategic wealth advisory for forward thinking individuals and families, supporting them to use their wealth with intention and purpose to create the life and legacy they choose.

Quick links

Contact details

© Zone Financial 2023 | AFSL 544 310 | ABN 51 604 835 921

Financial Services Guide | Terms & Conditions | Privacy Policy | Complaints and Disclaimers