Working with us

Trust and respect in every interaction.

For close to a decade, Zone Financial has become established as a trusted advisory in managing complex financial affairs. We specialise in investment consulting, strategic planning, tax efficient structures, and family office services, catering to a diverse clientele.

The experience our clients have when working with us, and how they feel (in addition to the results they achieve), is of the utmost importance. We work diligently and collaboratively to bring all elements of our clients’ strategies together in a seamless approach to ensure not only the best possible outcomes, but an enjoyable, stress-free financial management experience.

Who we help

We work with forward-thinking individuals inspired to use their wealth purposefully, live an exceptional life they feel proud of and create a secure future for those they care about.

Often our clients have experienced a significant life change – a major career move, inheritance, a divorce, retirement, or the sale of a business – adding a level of complexity that can be challenging to navigate alone.

Clients come to us seeking a long-term partnership with professionals who have the skills, expertise, and connections to support and guide them to make progress and solve complexities.

We help people create the sense of calm and confidence that comes through knowing their financial world is focused and on track, so they can create the life and legacy that is important to them.

Client stories

Our value is in the progress our clients make in their lives, the financial complexities that are solved and the peace of mind they have along the journey.

It’s not just our process that sets us apart, but the care and personal attention that goes into each step of the journey.

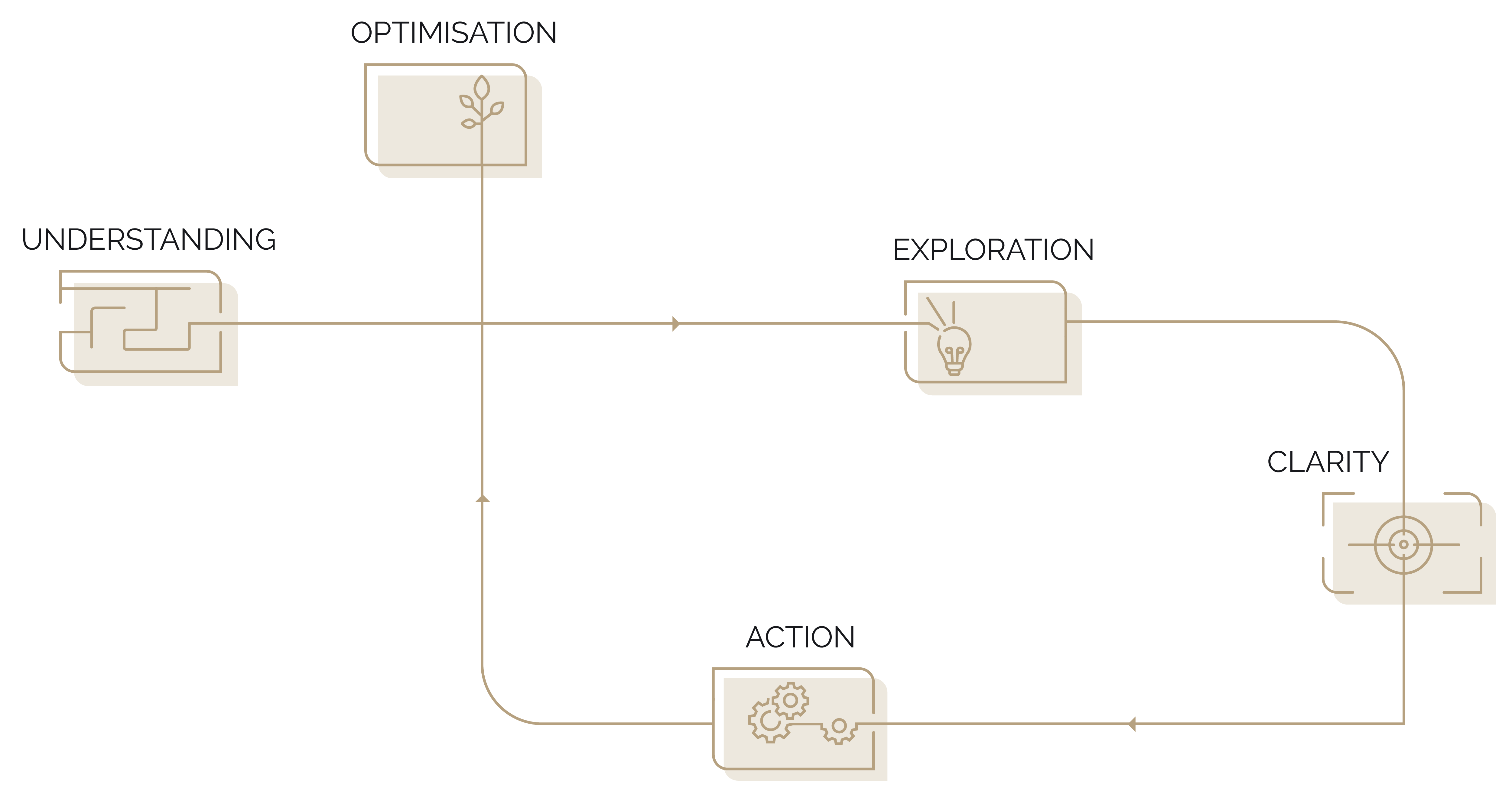

UNDERSTANDING

EXPLORATION

We consistently work to explore the constellation of viable financial decisions, by centralising and analysing all your financial information and assessing risks and opportunities through scenario planning and modelling. Utilising the combined technical expertise of our team, technologies, and research solutions, to give the greatest chance of financial success

CLARITY

We formulate and present you with carefully considered, clearly defined strategies and actions designed specifically to meet your requirements. Balancing your current lifestyle aspirations with your long term security, we help bring all areas of your financial life into focus – giving you clear options to consider in light of your long-term financial objectives.

ACTION

Once any necessary refinements have been made, we will implement and execute every aspect of your strategy, closely communicating with you and coordinating with the other Accounting, Legal or Tax professionals on your team.

OPTIMISATION

With ongoing monitoring and refinement, we comprehensively assess your financial strategy in order to manage risks and to take advantage of opportunities. Regular engagement with our team ensures your strategy continues to evolve and remains on track to build and preserve your wealth.

What you can expect when you entrust us as your wealth management partner.

Freedom to choose

When your options are expansive so are your opportunities

The uncompromised advice of a self-licensed wealth management partner, coupled with a clear, comprehensive wealth strategy, will give you a unique vantage point. We support you to gain a wide-ranging understanding of your opportunities and risks, giving you the freedom to make prompt decisions that will have the greatest impact on your life and legacy.

Confidence through partnership

Here with you, every step of the way

Trust and respect are not just things we value or words we say. They are the foundations of everything we do. You may come to us for our strategy and results, but we hope you’ll also feel the deep and genuine bonds we foster to ensure we’re always making a meaningful difference to your wealth and life. We form a deep understanding of your unique situation and priorities to provide guidance through life’s expected and surprise transitions.

Resilient and future-focused

Peace of mind means being prepared for the challenges as well as maximising your opportunities

With the knowledge that financial security is a long-term journey, we never put short term wins before financial longevity. Our balanced, considered approach to financial success ensures you have the capacity to absorb the unexpected and create the legacy that’s important to you in the years and decades to come.

Purposeful growth

Ensuring the momentum of your financial success

Our rigorous and proactive approach to your wealth strategy and investment structures will deliver clear, measurable outcomes. We value meticulous research, and evidence-based advice that puts us at the forefront of the financial industry, and you on the front foot in growing and protecting your wealth.

Questions we’re often asked

What you can expect when you entrust us as your wealth management partner.

How does the financial advice process work?

Our financial advice process involves:

- Initial consultation to understand your aspirations, your family, your values, your goals, your lifestyle needs, your financial situation, your complexities and your concerns.

- Analysis of your current financial position and future requirements, including research, scenario planning and modelling. Taking into consideration cash flow, debt, tax structures, investments, superannuation, insurance and estate planning.

- Development of a personalised financial strategy complete with specific plans and actions to progress you towards your financial goals and objectives. Ample time is spent explaining, clarifying and confirming the recommendations with you.

- Implementation of your strategy, including asset allocation, investment recommendations, risk management, tax structures and platforms (if required)

- Ongoing monitoring and refinement, to manage risks and opportunities to ensure your strategy continues to evolve and remains on track to best deliver what you want from life whilst continuing to build and preserve your wealth. This entails regular engagement with our team.

- Leading the collaboration with other professionals (such as specialist accountants, tax lawyers, estate and property specialists) to ensure your strategy is cohesive and seamless. We are not bound to any one partner and can seek opportunities to best suit your needs

Are you a fee-only or commission-based financial advice firm?

We are a flat dollar fee financial advice firm. Our fee will be confirmed with you before we provide any advice to you and is transparent and based solely on the services we provide. We do not earn commissions based on the size of the balance you have to invest. Our advice is unbiased and focused solely on your best interests, goals and financial objectives.

How do you charge for your services?

An initial flat dollar fee is charged for the initial work we will do to put your strategy in place. For the continued management, analysis and refinement of your strategy, an annual fee (prorated and paid in instalments over 12 months) will be charged and is often tax deductible.

Our fees are based on;

– The complexity of your financial situation and advice needs

– The frequency of engagement required

– The expertise and technical competence required to fulfil your needs

– The responsiveness and accessibility of our team

How do I become a client?

In all likelihood, you will have already been referred to us by a friend or family member. If they have not already done so, just ask them to send an introductory email (Cc’ing you) to one of our advisers. We will then contact you directly to schedule a time/date for an initial call, to talk about your requirements and confirm whether we will be able to assist.

The relationship will then evolve over a series of meetings:

At the Discovery Meeting we will;

– Discuss your reasons for seeking advice

– Understand your story and explore what is important to you

– Identify your goals, lifestyle aspirations and plans for the future

– Explain our business model, fees and processes

At the Strategy Meeting we will;

– Analyse the complexities of your current financial situation

– Review how your assets are allocated

– Evaluate and discuss options and priorities

– Engage in scenario planning

– Gain your approval to commence the process of building your financial strategy

At the Financial Advice Delivery Meeting we will;

– Confirm the strategy and recommendations

– Explain financial models that we have built specific to your strategy

– Discuss the outcomes and the alignment with meeting your goals and milestones

– Gain your approval to move forward with the recommendations

At Progress Meetings we will;

– Review the progress you are making towards achieving your goals and objectives

– Ensure your strategy remains aligned with your goals

– Collaborate with external advisers where required (Accountants, Lawyers etc)

– Adapt to any changes in your circumstances and the legislative and economic landscape.

– Set clear action items

– Ensure changes are implemented efficiently to optimise your strategy and outcomes

Does Zone Financial have any ownership or vested interest in financial product providers?

No, Zone Financial is privately owned and licensed. We are not affiliated with any banks or institutions. We do not have any financial interest in related or associated companies that issue financial products. We have a very intentional business model that is free from conflicts of interest.

Kind words from

our clients

Zone Financial

We are a strategic wealth advisory for forward thinking individuals and families, supporting them to use their wealth with intention and purpose to create the life and legacy they choose.

Quick links

Contact details

© Zone Financial 2023 | AFSL 544 310 | ABN 51 604 835 921

Financial Services Guide | Terms & Conditions | Privacy Policy | Complaints and Disclaimers