The impact of ‘controlling the controllables’

When it comes to controlling your finances, personal finance is a complex and dynamic labyrinth to navigate. Interest Rates. Markets. Stock prices. Inflation. With so much external variability, at times it feels like the wheel is beyond grasp. Yet, while it is the case that external forces can and often do impact our financial position, this does not mean we should feel powerless. There are a great many factors in our financial lives that we can control.

At Zone Financial we understand the power of recognising and controlling those factors within our reach: what we call ‘controlling the controllables.’ This is a powerful guiding principle, and one that benefits our clients daily on their various paths to financial prosperity.

What It Means

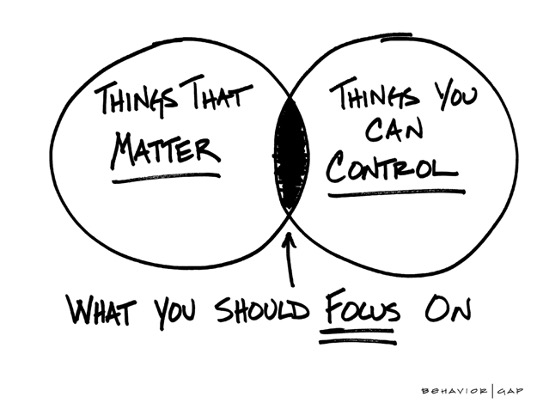

At its core, controlling the controllables is a mindset, more than a specific checklist of prescriptions. The fundamental idea is to focus energy and attention on factors within one’s control, rather than being distracted by — or consumed by — external variables. In the realm of finance, this means acknowledging that while you can’t predict or control market fluctuations or economic downturns, you can take proactive steps to manage your personal finances effectively.

The Five Principles of Controlling the Controllables

As a reputable, holistic financial advice firm, Zone Financial empowers clients to effectively embrace and implement the principle of controlling the controllables. By providing expert guidance and strategic planning, we allow clients to take charge of their financial journey in meaningful ways, and to navigate the complex financial landscape with a sense of calm.

Here are our 5 key principles for adopting a mindset of controlling the controllables in your pursuit of financial success:

1. Be Clear. One of the first steps in taking control of your financial future is defining clear and realistic goals. Everyone has a different vision of their ideal lifestyle and legacy, and it’s important your financial strategies align with the short and long-term goals you wish to achieve. Whether it’s retirement planning, wealth accumulation, education funding, or asset protection — through detailed discussions and personalised strategies, Zone Financial helps clients identify, clarify, and foreground life goals, ensuring aspirations and financial endeavours align.

2. Finger on the Pulse. Given the dynamic and often volatile nature of markets, information — reliable and current — can often mean the power to minimise risk and maximise potential reward. As a team that lives and breathes finance, Zone Financial stays updated on market trends, economic indicators, and investment opportunities. By keeping a finger on the pulse, we help clients make timely, well-informed decisions, and to capitalise on potential opportunities as they arise.

3. The Power of Diversification. Managing risk is a crucial aspect of any financial plan. Market fluctuations, economic uncertainties, and unforeseen events are beyond our control, and having all one’s eggs in one basket can increase the risk of these external forces negatively impacting a portfolio. The best defence in these circumstances is to maintain a well diversified portfolio with exposure to a broad set of risk and returns. Diversification, along with asset allocation and contingency planning, helps protect our clients from potential pitfalls and the impacts of inevitable market turbulence.

4. Stay Calm. One of the most valuable contributions of financial advisors is an ability to provide behavioural coaching. Investing can be an emotional rollercoaster. In such an environment, advisors serve as objective voices, helping our clients stay disciplined, focused, and rational during market volatility or times of financial stress. By addressing behavioural patterns and providing guidance, we foster a long-term mindset, enabling clients to make calm, rational decisions, even in times of market uncertainty.

5. Never Fly Solo. Financial advice is not a one-time service; it’s an ongoing partnership. As advisors we measure and monitor your portfolio’s performance, consistently assess and reassess financial strategies, and make necessary adjustments to adapt to changing circumstances. We can’t control the speed at which financial markets move, legislative requirements change or your personal life rapidly shifts. But we can control how quickly and expertly these changes are factored into your financial strategy. By having a trusted advisor — to analyse challenges, project possibilities and review trade-offs from competing choices — our clients keep expert guidance close at hand, ensuring clarity and confidence in any decision making that’s required.

In an uncertain financial landscape, ‘Controlling the Controllables’ is a powerful concept that puts the power of clarity back in your hands.

By seeking the guidance of a trusted financial advice firm, clients can leverage the expertise and resources needed to effectively implement this philosophy. Through comprehensive planning, expert insights, risk management, behavioural coaching, and continuous monitoring, Zone Financial provides the tools and support necessary to navigate the complexities of the financial world.

Remember, while external variables may be unpredictable, your financial future can be shaped by making those sound and informed decisions that are within your control. Be clear. Keep a finger on the pulse. Diversify. Stay Calm. And never fly solo.

Disclaimer: This article has been prepared for information purposes only and does not constitute investment or financial advice. Any information, material or commentary is intended to provide general information only and Zone Financial Pty Ltd makes no representation as to its accuracy or completeness. Before acting on any information contained in this document, each person should consider its appropriateness having regard to their own or their clients’ individual objectives, financial situation and needs. You should obtain independent taxation, financial and legal advice relating to this information and consider it carefully before making any decision or recommendation.

Further reading

Understanding investor temperament

In the world of finance, where markets are often unpredictable and emotions run high, understanding and nurturing investor temperament is key to achieving long-term financial success. This article explores the concept of investor temperament, delving into the differences between delegators and validators, and uncover how a trusted financial adviser can significantly enhance your investment experience.

Long term investing: The power of the long game

In the fast-paced world of finance, where trends come and go, it’s easy to be enticed by the allure of quick gains and instant gratification. However, the true power of investing lies in recognising that it is a long game—a patient and strategic journey that can lead to substantial wealth and financial success.

Zone Financial

We are a strategic wealth advisory for forward thinking individuals and families, supporting them to use their wealth with intention and purpose to create the life and legacy they choose.

Quick links

Contact details

© Zone Financial 2023 | AFSL 544 310 | ABN 51 604 835 921

Financial Services Guide | Terms & Conditions | Privacy Policy | Complaints and Disclaimers