Financial Market Update

Quarter 2, 2024

Key points

- Concerns in April that sticky inflation would delay interest rates cuts subsided over May and June.

- Global equities continued to be led higher by the technology sector.

- Australian equities underperformed as some commodity prices as resource stocks weakened

Global Equities Rally As Inflation Fears Subside

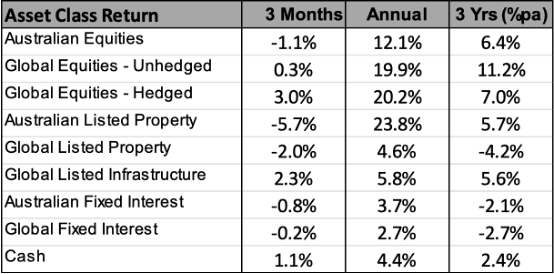

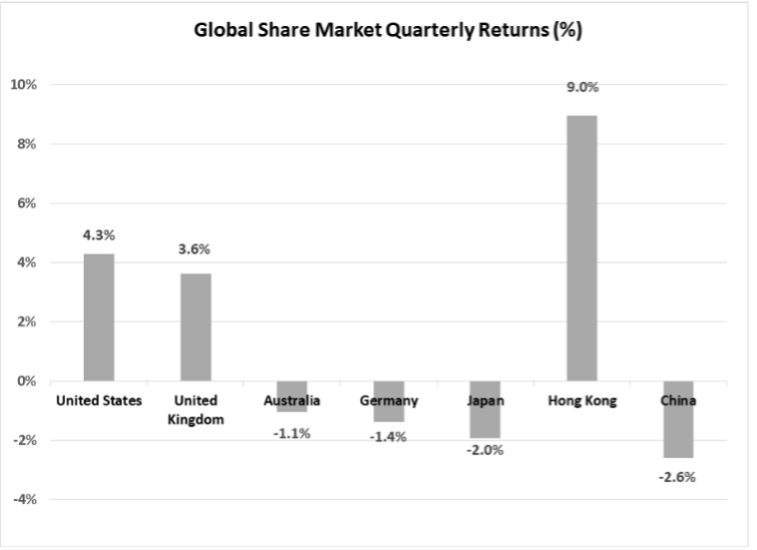

European markets were generally weaker over the June quarter, with European Union parliamentary elections producing a material swing to more right winged parties. This prompted the French President, Mr. Macron, to call a snap legislative election, which caused concerns on both French bond and equity markets. The French share market fell by 8.4%, with losses also recorded in Germany last quarter. The United Kingdom, which has its own election on July 4th, bucked the trend, finishing 3.6% higher.

The Japanese market also finished in negative territory, with the Nikkei Index falling 2.0%. Further weakness in the Japanese Yen (which has depreciated 11.1% against the $A over the past year), is placing some pressure on the Bank of Japan to increase interest rates from abnormally low levels as their domestic inflation shifts higher. Japan’s 10-year bond yield rose above 1%, which is the highest level for 11 years and reflects the expectation that Japanese monetary policy will be tightened.

Emerging economy share markets were mixed over the quarter. There were strong performances from India (up 9.9%) and Taiwan (up 16.3%). However, these gains were partially offset by a 2.6% fall in China, where concerns over the economic growth outlook are ongoing. This weaker Chinese growth outlook resulted in declines on some commodity markets, which also resulted in negative results from most South American markets. None-the-less, the overall MSCI Emerging Markets Index still finished in positive territory over the quarter with a gain of 2.6%.

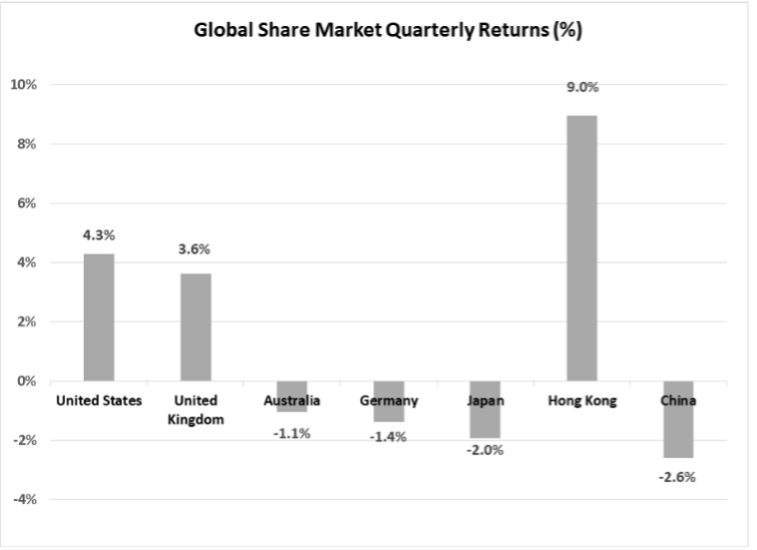

With bond yields moving higher over the quarter, there was a sell-off on listed property markets. Global listed property finished 2.0% lower, with the Australian property sector declining 5.7%. Infrastructure, however, proved less sensitive to bonds yields and moved 2.3% higher.

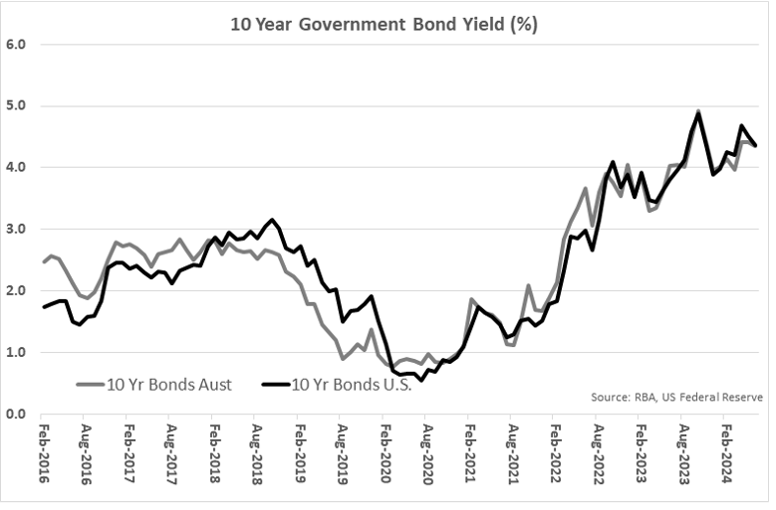

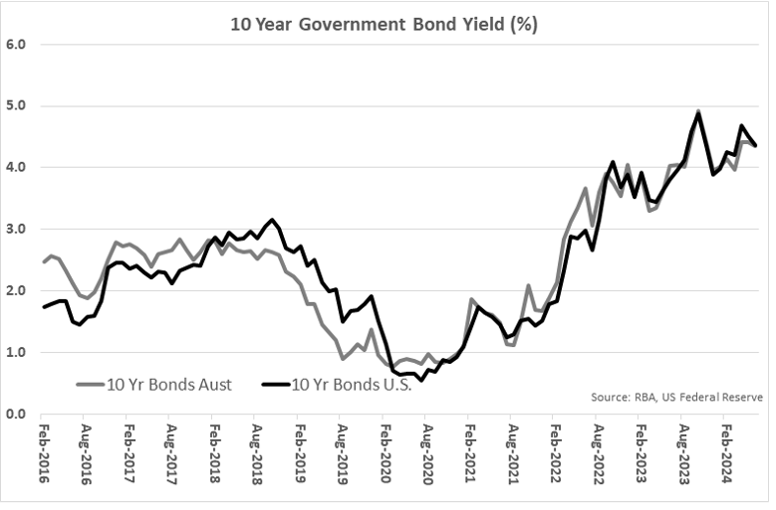

Yields Finish Quarter Higher Despite Some Policy Easing

There was a more significant increase in the Australian equivalent, with the 10-year yield here moving from 3.96% to 4.35%. Conditions on credit markets remained favourable, with an absence of any significant rise in corporate defaults. Higher credit security returns offset some of the small capital loss generated from rising bond yields last quarter.

Although there was no change in cash interest rates in Australia or the U.S. last quarter, there were policy reductions announced in the European Union, Canada, and Switzerland. Locally, there was more market participants predicting a cash rate increase by the Australian Reserve Bank this year because of higher-than-expected inflation indicator data for the month of May.

Despite some weakening in commodity prices, the $A held its value last quarter, rising from US 65.3 cents to U.S. 66.2 cents. Gains against both the Yen and Euro were more impressive, with the $A’s appreciation being 7.8% and 2.7% respectively. However, trade fundamentals may become less supportive for the $A, with the Current Account moving into a deficit position in the March quarter. A weakening in the Terms of Trade (the ratio of change in export prices to import prices) was also contained in the Commonwealth Government’s Budget forecasts made in May.

Considerations For Investors

The June quarter capped off an outstanding financial year for share markets, with global developed markets rising by an average of just over 20%. This increase is nearly 3 times the long-term annual average and reflects a combination of the following factors:

- A global recession, that was widely predicted due to higher interest rates, did not eventuate.

- Inflation has gradually moved back towards long-term targets across the globe.

- There has been a significant increase in both actual and expected profitability from technology companies, with the evolution of Artificial Intelligence being a primary catalyst for this.

Despite areas of geopolitical tension and the uncertainty caused by a myriad of key elections, investor sentiment remains buoyant. Concerns stemming from the sharp declines in commercial property valuations, and the collapse of some second-tier banks in the United States, have not generated the same contagion effect on confidence that they would have in past periods when financial markets were more fragile and structurally deficient due to high leverage.

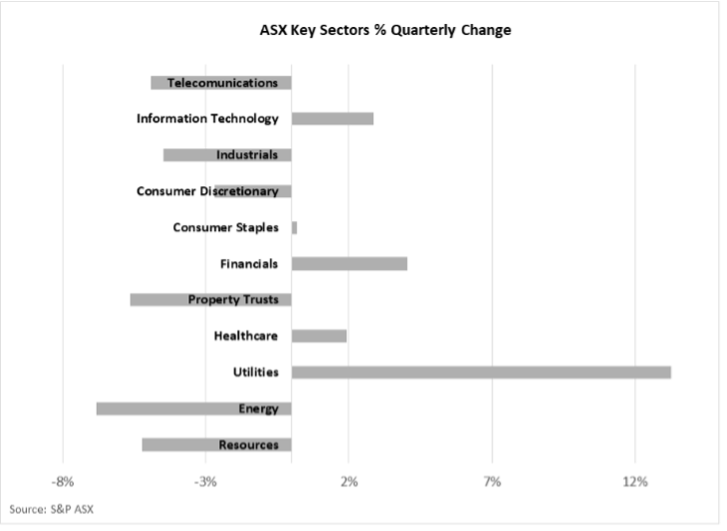

Notwithstanding the clear rationale for the rally on global equity markets over the past year, it is less obvious as to why the Australian share market has participated in this rally to the extent that it has. The lack of a sizeable Information Technology sector provides much of the rationale for an 8% performance differential between the Australian share market return and the global average over the past year. None-the-less, it could be argued that the 12% rise in Australian share prices is at odds with underlying fundamentals, which are far less favourable than those of the United States.

Effectively, the Australian economy is in recession. On a per person basis, economic growth has contracted by 1.3% over the past year. The latest National Accounts data showed a significant build-up in inventories, which adds to the probability of weaker growth data in the period ahead. Productivity has experienced the largest fall on record, and, with the household savings ratio now close to zero, there is limited scope for consumers to increase spending in the near term. Our major trading partner, China, is also experiencing weak economic growth and this has contributed to falling commodity prices and a shift in Australia’s Current Account (our net earnings from trade and foreign income) from surplus to deficit. Given this backdrop, share price gains for the financial sector (up 29%) and consumer discretionary stocks (up 23%) over the past year seem difficult to reconcile.

Company earnings growth fundamentals do appear weaker in Australia than those of the U.S. and, indeed, those of many emerging economies. As such, the case for healthy international diversification of equity exposure is strong. Conversely, an opportunity may be emerging within longer-term Australian interest rates, which may ultimately need to fall given that the Australian economy is weaker than perhaps bond markets are implying with 2-year yields above 4%.

Despite the challenges presented by the Australian economy, the past year has highlighted the resilience of financial markets and the robustness of corporate balance sheets and earnings. Share markets and corporate credit markets have rallied despite an unusual range of challenges and uncertainties over the past year. Notwithstanding this resilience, valuations for some assets have moved to the upper ranges of fair value and investors should seek to manage this valuation risk by holding healthy exposures to sectors such as emerging markets and smaller companies to diversify away from the more expensive end of the share market. These sectors continue to offer more attractive valuations yet still provide a reasonable prospect of further earnings growth.

The following indexes are used to report asset class performance: ASX S&P 200 Index, MSCI World Index ex Australia net AUD TR (composite of 50% hedged and 50% unhedged), FTSE EPRA/NAREIT Developed REITs Index Net TRI AUD Hedged, Bloomberg AusBond Composite 0 Yr Index, Barclays Global Aggregate ($A Hedged), Bloomberg AusBond Bank Bill Index, S&P ASX 300 A-REIT (Sector) TR Index AUD, S&P Global Infrastructure NR Index (AUD Hedged).

This Market Update contains information that is general in nature. It does not constitute financial or investment advice. Any information, material or commentary is intended to provide general information only. Zone Financial Pty Ltd makes no representation as to the accuracy or completeness of the information. Before acting on any information contained on this website, each person should consider its appropriateness having regard to their own or their clients’ individual objectives, financial situation and needs. You should obtain independent taxation, financial and legal advice relating to this information and consider it carefully before making any decision or recommendation.

Zone Financial Pty Ltd ABN 51 604 835 921, AFSL 544 310.

Further reading

Zone Financial

We are a strategic wealth advisory for forward thinking individuals and families, supporting them to use their wealth with intention and purpose to create the life and legacy they choose.

Quick links

Contact details

© Zone Financial 2024 | AFSL 544 310 | ABN 51 604 835 921

Financial Services Guide | Terms & Conditions | Privacy Policy | Complaints and Disclaimers