Federal Budget May 2023

What it might mean for the markets

Addressing short-term pain but with limited long-term gain

- The Federal Government has delivered a prudent Budget that seeks to address cost of living pressures without adding to inflationary pressures (but unfortunately neither to long term growth potential). The Budget has posted its first surplus since 2007-08, due primarily to surging tax receipts although this is set to deteriorate in coming years despite a rising tax take.

- Major spending initiatives have been targeted at lower income households, but in such a way as to attempt to minimise the inflationary impact. We don’t believe this Budget is inflationary given fiscal policy is contractionary (via a surplus) rather than expansionary and given the targeted nature of the spending. However, the Budget provides relief for inflation rather than a solution.

- It is not a ‘pro-growth’ Budget given a dearth of policies addressing productivity or other long-term major structural reforms. We expect the budget to have limited impact on the longer-term economic growth outlook with deficits expected to rise, unemployment to tick higher (peaking at 4.5%) and for inflation to remain well above the RBA’s 2-3% target range out through 2025.

- While the Budget addresses short-term pain, particularly for households and small businesses, it doesn’t go far enough to address longer term costs associated with the ballooning NDIS and interest payments. This will weigh on the structural position of future Budgets and in turn reduce future fiscal flexibility without a strong rise in tax receipts.

- Who wins? Lower income households will benefit from energy cost relief and increased welfare payments. Small businesses will benefit from energy relief and clean energy subsidies. Aged care workers will benefit from wage increases. The ‘build-to-rent’ sector will also benefit and this may make an impact in the long term on housing supply.

- Who loses? Offshore gas and oil projects have seen their PRR tax liabilities bought forward. Superannuation savers with balances above $3m will pay an additional 15% tax on the income generated from their fund.

- Given the Budget is directed towards income relief rather than boosting economic growth, its unlikely to be greeted with much fanfare from financial markets. On the positive side, a mild rise in the future path of deficits will reduce pressure on Australia’s credit rating and in turn downside pressures for the Australian dollar.

- However, the relief for business via energy and/or utility costs is unlikely to be sufficient to offset margin pressures from rising raw material costs and wage pressures. In addition, sticky inflation will prevent a quick reversal (normalisation) in policy rates implying higher financial costs will remain a headwind for earnings.

- We doubt the budget is enough to provide a sustained boost to consumer spending as welfare payments only provide a temporary offset to cost of living pressures. Policies to deal with the impact of rampant inflation do nothing to bring inflation down (they simply deal with the symptoms). Against a backdrop where economic growth weakens, where unemployment rises, where inflation remains elevated and where income support is temporary, we see no reason why our near-term cautious view on the equity market should change.

First surplus in 15 years…

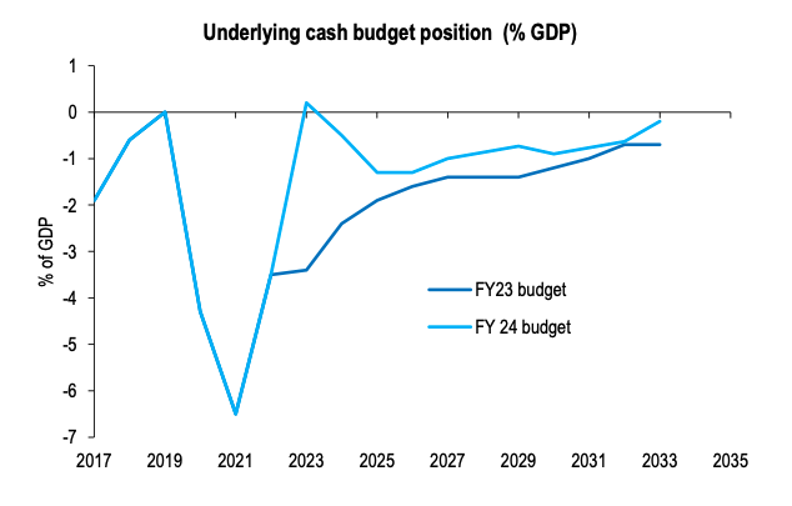

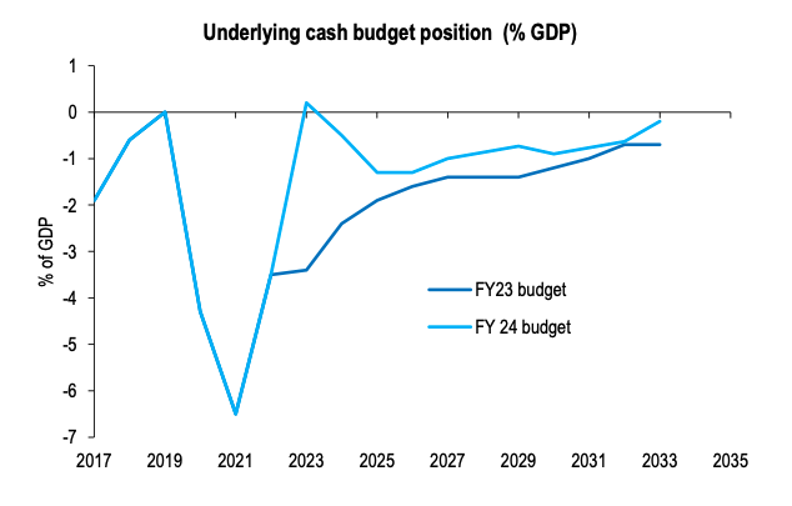

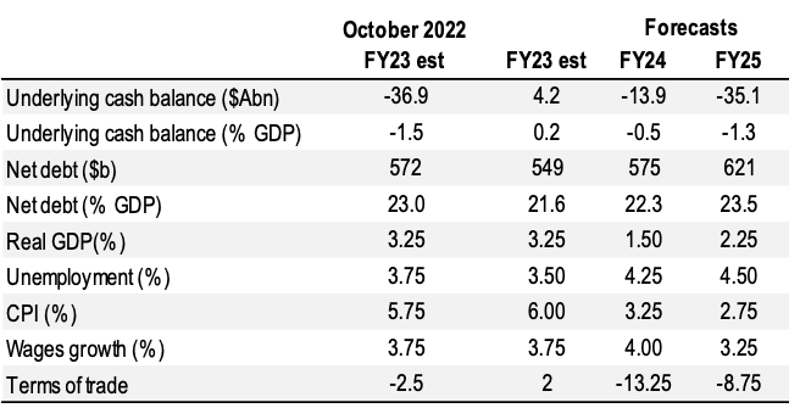

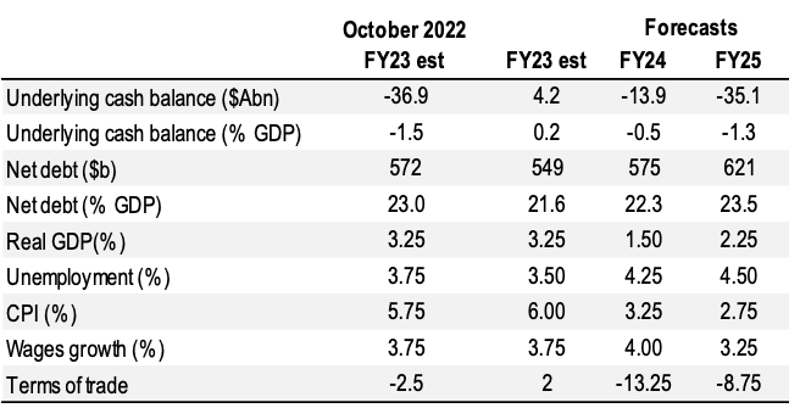

The Federal budget highlights how changing economic fortunes can turn the budget on its head. After forecasting a FY23 deficit of $37 billion or 1.5% of GDP back in October 2022, the Government now expects a surplus of $4 billion (0.2% of GDP).

The turnaround represents the first surplus in 15 years and is due to a surge in company tax revenue from the resources sector. However, the turnaround would not be possible without a strong labour market and corporate sector outside of resources. Personal income tax revenue increased from $259 billion in FY22 to $297 billion. Corporate tax revenue increased from $123.3 billion in FY22 to $138.4 billion.

Underlying cash budget position % of GDP

Source: Commonwealth Treasury, MWM Research, May 2023

This is expected to be as good as it gets. The surplus is forecast to be short-lived, and the budget is expected to slip back into deficit in FY24 (-$13.9 billion) and in the out-years reflecting growth in interest payments of 8% pa and in the NDIS of 10% pa. Growth in defence, aged care hospitals and medical benefits are all preventing the budget from returning to surplus over the longer term.

Economic growth is forecast at only 1.50% in FY24 and 2.25% in FY25 which is a significant step down from recent years, given the impact of monetary tightening around the world, and this is on the assumption that the global recession we expect will be mild and shallow. A more protracted global downturn will made this difficult to achieve.

Key fiscal and economic forecasts

Source: Commonwealth Treasury, MWM Research, May 2023

…due to a strong labour market and commodities

Income tax receipts have been boosted by inflation and a near-record low unemployment rate of 3.5%, which has boosted wages growth and pushed many workers into higher tax brackets via ‘bracket creep’. A sharp rise in migrant workers entering the country has also boosted the wages and therefore tax bill. The Budget benefited from higher-than-expected prices for iron ore, coal and gas exports, which have seen the country’s exports rise to a record high.

Wages (and income taxes) benefiting from strong labour market and inflation

Source: ABS, Factset, MWM Research, May 2023

Aims of the Budget

The key aim of the Budget is to assist with cost-of-living pressures, without adding to inflationary pressures which we see as a difficult intention. More cash is being handed out to welfare recipients, which is likely to add to inflationary pressures, but the design of the energy cost relief package is being provided by way of tax credits and discounts and this will notionally put downward pressure on inflation.

Major budget initiatives

We review the major initiatives below:

Cost of living pressures

- The budget attempts to provide cost of living relief via reducing energy costs and funding welfare programs such rental assistance, Youth Allowance, Childcare and Austudy.

- Up to $3 billion in electricity bill relief for eligible households (up to $500 each) and small business (up to $650 each). The discounts would be administered by state governments and applied to energy bills to avoid exacerbating inflation.

- Small business ($50 million turnover max) may receive a tax deduction of up to $20,000 when they invest in eligible assets supporting electrification and more efficient use of energy.

- Around $1.9 billion will be added to welfare payments to single parents over the forward estimates.

- Payments from the Jobseeker, Austudy and youth Allowance programs have been increased by $40 per fortnight and payments to Jobseeker recipients aged 55-59 have been increased by $92.10 per fortnight, costing $4.9 billion over 5 years.

- Rental assistance: Increasing the maximum rates of Commonwealth Rent Assistance by 15% at a cost of $2.7 billion over 5 years.

Petroleum Resources Rent Tax (PRRT)

- Tax deductible expenditure will be limited to 90% of project revenue in the relevant year. This will bring forward the date that liquefied natural gas projects are expected to pay their PRRT. They were not expected to pay any significant amount until the 2030s under previous tax arrangements.

- This is expected to increase tax receipts by $2.4 billion over the forward estimates.

ESG initiatives

- Ahead of the Budget the Government announced its intention to establish on 1 July a Net Zero Authority that would centrally manage Australia’s decarbonisation efforts. The Net Zero Authority would aid coal-dominated regions and their workers in their transition away from coal into new clean energy industries.

- Alongside the formation of the agency, $400 million from the $1.9 billion Powering the Regions Fund would also be deployed to help workers and communities manage decarbonisation.

- The $1.3 billion Household Upgrades Energy Fund will create low interest loans and fund upgrades to social housing to improve energy performance.

- The $2 billion Hydrogen Headstart will accelerate large-scale renewable hydrogen projects.

More affordable housing

- Build-to-rent: Incentives to encourage the supply of housing, including 1) reducing withholding tax rate from 30% to 15% for managed investment trusts attributed to newly constructed build-to-rent developments and 2) increasing the capital works tax deduction rate from 2.5% to 4.0% for newly constructed build-to-rent developments.

- More social and affordable housing through a $2 billion increase in National Housing Finance and Investment Corporation’s liability cap.

Superannuation tax

- The income from superannuation balances above $3 million will be taxed at 30% rather than 15% under the current arrangements. This is expected to increase tax receipts by $900 million over the forward estimates.

NDIS and health

- $5.7 billion over 5 years from 2022—23 to strengthen Medicare and make it cheaper and easier to see a doctor.

- Dispensing rules will be changed for pharmacies to allow around 6 million people to buy two months’ worth of medicine for the price of a single prescription. The cost of the program is estimated to save around $1.2 billion and this will be reinvested into community pharmacies.

- Aged care workers will receive a wage rise which will rise from $11.3 billion over the forward estimates period to $14.1 billon.

Defence

- The changing geopolitical and national security landscape has driven an increase in defence spending.

- Bonuses will be offered to existing ADF staff if they reenlist for another three years. This initiative is expected to cost $400 million over the next four years.

- More than 30 defence projects will be either scaled back, delayed or cut to save $7.8 billion and to help fund a $19 billion spending increase over the next four years that will be fully offset.

Tobacco tax

- The tobacco tax will increase by 5% per year over three years and raise $3 billion in revenue over the forward estimates.

Education

- $3.7 billion in additional funding will be allocated to the National Skills Agreement taking total Federal government spending to $12 billion.

Infrastructure

- Up to $3.4 billion over 10 years for investment in Brisbane 2032 Olympic and Paralympic Games venue infrastructure.

Recreation and culture

- Cultural institutions such as museums and art galleries will benefit from $535m in funding to refurbish and upgrade the facilities.

- The government has decided to assist the establishment of an AFL team in Tasmania at a cost of $300m.

- National parks will benefit from the $263m set aside for investment.

Economic Impact

The impact on the overall economy will be muted. Some less advantaged households will feel better off although any cost-of-living adjustments will likely be quickly absorbed. While this should improve sentiment for lower-income households in the near-term, we don’t believe it will drive meaningful upside in spending in aggregate.

Source: Macquarie -10th of May 2023.

Zone Financial Pty Ltd ABN 51 604 835 921, AFSL 544 310.

Further reading

Zone Financial

We are a strategic wealth advisory for forward thinking individuals and families, supporting them to use their wealth with intention and purpose to create the life and legacy they choose.

Quick links

Contact details

© Zone Financial 2023 | AFSL 544 310 | ABN 51 604 835 921

Financial Services Guide | Terms & Conditions | Privacy Policy | Complaints and Disclaimers