Financial Market Update

Quarter 3, 2023

Key points

- Global share markets sold off during the September quarter, following a period of strong increase.

- A significant rise in bond yields was the main catalyst for the weaker share markets.

- The more interest rate sensitive sectors of infrastructure & property were sold off heavily over the quarter.

Higher Bond Yields Worry Equity Markets

The re-emergence of inflation concerns, and the ongoing strength of the United States economy, led to a recalibration of interest rate expectations last quarter. Market consensus has swung towards a view that existing elevated cash interest rates will need to be maintained for some time, with central banks having minimal scope to cut interest rates in 2024. A key part of the rationale for this shift in consensus is the ongoing strength evident in the U.S. economy. In addition, there was also increasing concern last quarter over the inflationary impact of rising oil prices. Buoyant demand and ongoing supply constraints saw the global oil price jump 28.5%.

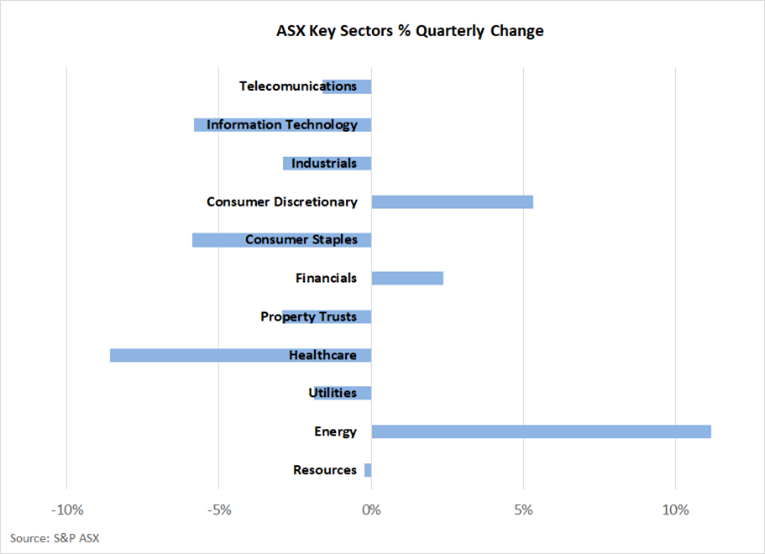

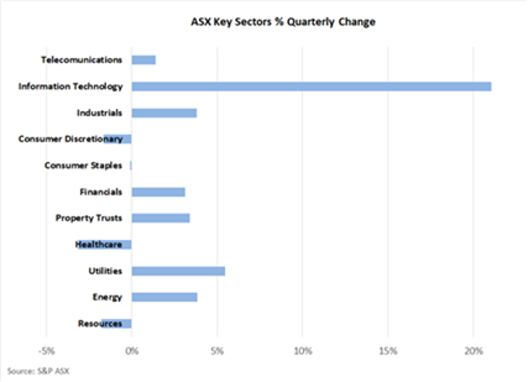

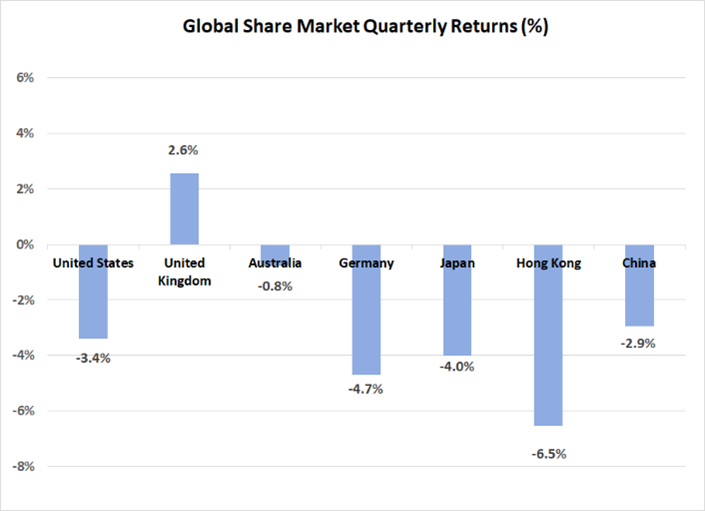

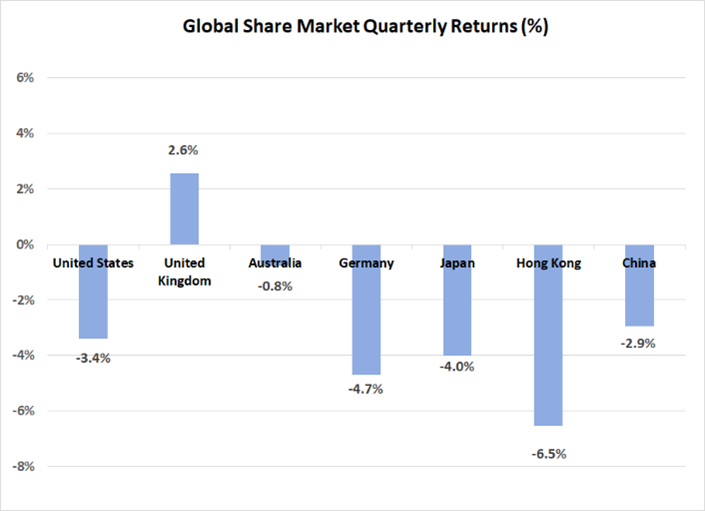

Global developed markets were generally lower by between 4% and 5%, although the United Kingdom was an exception, posting a 2.6% increase. The higher oil price and some weakness in the value of the Pound assisted the U.K. market last quarter. The United States (down 3.4%), where the bond yield increase was most significant, led the global market to lower over the quarter. A reversal of some recent strength in the Information Technology sector (which dropped 5.7%) also weighed more heavily on the U.S., given its dominance in the sector mix there.

Emerging markets performed better than developed markets and the MSCI Emerging Markets Index was actually positive 0.1% in $A terms over the quarter. The ongoing lack of any significant economic policy stimulus continued to weigh on the Chinese share market. Policy initiatives announced to date have been of a smaller scale than expected. Several measures announced by Chinese authorities have been targeted at supporting the ailing property sector, with reduced stamp duties and lower mortgage rates and down payment ratios being put in place recently. Losses on the Chinese market over the quarter (down 2.9%) were offset by gains in India (up 4.0%), with oil exporting nations also positive, boosted by the stronger crude oil price.

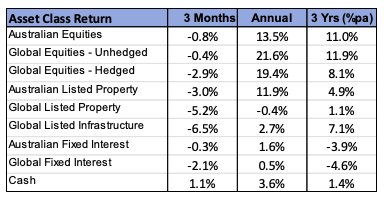

Higher bond yields detracted from the appeal of property and infrastructure investments, which were sold down heavily. Global infrastructure stocks dropped by 6.5%, with global listed property 5.2% lower. The Australian REIT sector fared slightly better (down 3.0%), with the largest constituent, Goodman Group (up 6.9%), enjoying a positive response from its strong earnings result.

Cash stable but longer term bond yields rise sharply

There was minimal change in cash interest rates last quarter. The Australian RBA left monetary policy unchanged, with the cash interest rate set at 4.10%. The United States Federal Reserve made one 0.25% increase in the cash target early in the quarter to bring the rate to a 5.25% to 5.50% range.

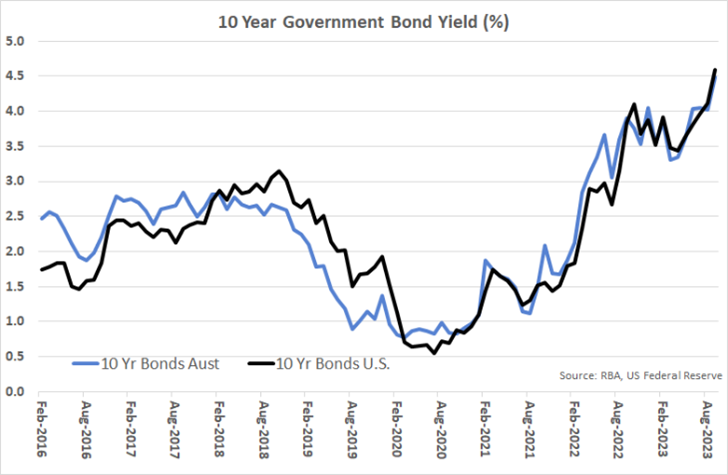

However, despite the stability at the front end of the yield curve, there was significant increase in longer term bond yields. In the United States, the 10-year Treasury bond yield jumped from 3.81% to 4.59%. In Australia, the increase in yields was more modest, but still significant, with the 10-year yield rising from 4.03% to 4.48%. These yield increases created capital losses in fixed interest asset classes.

Stronger economic data, and increased inflationary pressures from oil prices, have been two contributors to the higher bond yields. In addition, there has been increased focus on the size of the United States government debt position and the ongoing need to issue more bonds – with the bond supply addition potentially causing further bond price weakness (pushing yields higher).

With the sharp increase in U.S. bond yields, the rally in the value of the $US continued over the quarter. This strength in the $US saw a corresponding fall in the $A, which dropped from U.S. 66.3 cents to U.S. 64.6 cents. The $A did, however, appreciate slightly against the Japanese Yen (up 0.4%) and the Euro (up 0.1%).

Considerations for investors

Whilst dramatic movements on equity markets often dominate the finance headlines, the upward shift in bond yields recorded over the past two months has been somewhat remarkable and unexpected. Between the first weeks of August and October, the U.S. 10 year treasury bond yield has jumped from 4.0% to 4.8%. In the context of long term bond yields, that is a significant change and has ramifications for the pricing of all financial assets.

Prior to this hike in yields, there appeared to be a growing consensus that the fight against inflation was being won, which would allow for a period of stability in monetary policy and interest rate settings. However, a jump in the oil price, some stronger than expected U.S. economic data and a re-focussing by markets on the deficit and future funding requirements of the U.S. government (possibly triggered by the Fitch credit rating downgrade), has radically changed the course of bond markets.

The reaction of share markets to the sharp escalation in bond yields over the past two months has been both logical and quite modest relative to the size of the increase in yields. All else being equal, higher bond yields should result in equity market decline, as share prices need to adjust downwards in order for future equity market returns to provide the same risk premium over bonds (the “relative value” effect). This response is most “automatic” for those equities where stable yields are the primary source of return, which explains why property and infrastructure have fared so poorly over recent weeks. However, the broader market should, and has been, impacted by the rise in yields, with those companies with a high dependence on borrowings impacted by both the “relative value” effect as well as a direct fall in expected net earnings due to higher borrowing costs.

Often, an increase in bond yields occurs due to an improvement in the economic outlook that creates an anticipation that tighter monetary policy will be forthcoming. Subsequent improvements in earnings forecasts may offset some or all of the negative effect of higher bond yields on equity valuations. However, improved earnings forecasts have not been a feature of the past two months, hence the logical downward movement on share markets. For Australia, whilst the jump in yields has been slightly less significant (the 10-year yield has increased from 4.0% to 4.6% in the two months to early October), the change has created an interesting dichotomy, whereby our yield curve has steepened and become more “normal”; whereas the U.S. yield curve remains negative courtesy of their higher cash interest rate.

Although the rise in longer term bond yields has created some shorter term pain for investors, the positive aspect of the shift for investors is that returns for risk free assets have fundamentally increased over the past two months. For Australian investors, the fact that yields here have been “led” higher by global factors, increases the attractiveness of local longer term yields. There is now a material premium on offer over cash, which is perhaps not justified by fundamentals. Australia’s economy has weakened over the course of 2023 and has contracted on a per person basis. This would normally be associated with an increased probability of future softening in policy and interest rates. As such, the recent jump in longer term yields may present an opportunity to “lock-in” a return premium that could play a valuable role in portfolios if economic weakness continues.

Important Information

The following indexes are used to report asset class performance: ASX S&P 200 Index, MSCI World Index ex Australia net AUD TR (composite of 50% hedged and 50% unhedged), FTSE EPRA/NAREIT Developed REITs Index Net TRI AUD Hedged, Bloomberg AusBond Composite 0 Yr Index, Barclays Global Aggregate ($A Hedged), Bloomberg AusBond Bank Bill Index, S&P ASX 300 A-REIT (Sector) TR Index AUD, S&P Global Infrastructure NR Index (AUD Hedged).

This Market Update contains information that is general in nature. It does not constitute financial or investment advice. Any information, material or commentary is intended to provide general information only. Zone Financial Pty Ltd makes no representation as to the accuracy or completeness of the information. Before acting on any information contained on this website, each person should consider its appropriateness having regard to their own or their clients’ individual objectives, financial situation and needs. You should obtain independent taxation, financial and legal advice relating to this information and consider it carefully before making any decision or recommendation.

Zone Financial Pty Ltd ABN 51 604 835 921, AFSL 544 310.

Further reading

Zone Financial

We are a strategic wealth advisory for forward thinking individuals and families, supporting them to use their wealth with intention and purpose to create the life and legacy they choose.

Quick links

Contact details

© Zone Financial 2023 | AFSL 544 310 | ABN 51 604 835 921

Financial Services Guide | Terms & Conditions | Privacy Policy | Complaints and Disclaimers