Financial Market Update

Quarter 1, 2024

Key points

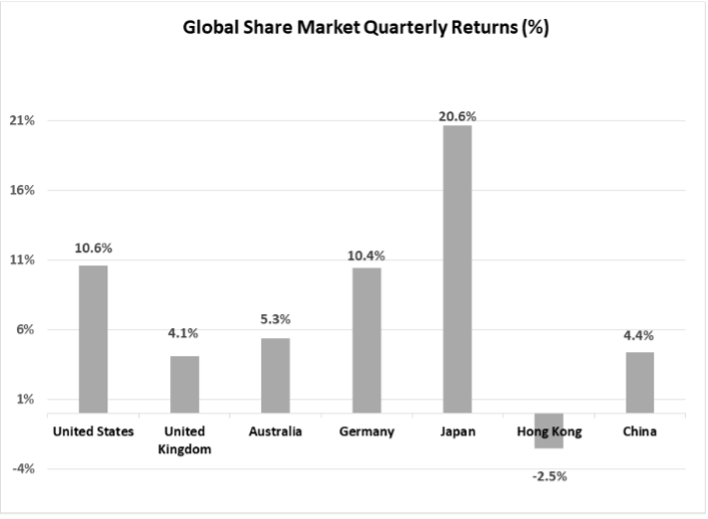

- The global equity rally continued over the March quarter, with positive earnings results in the U.S. technology sector being the main catalyst for continued price growth.

- Global bond yields inched higher as markets pushed back the expected timing of any interest rate cuts

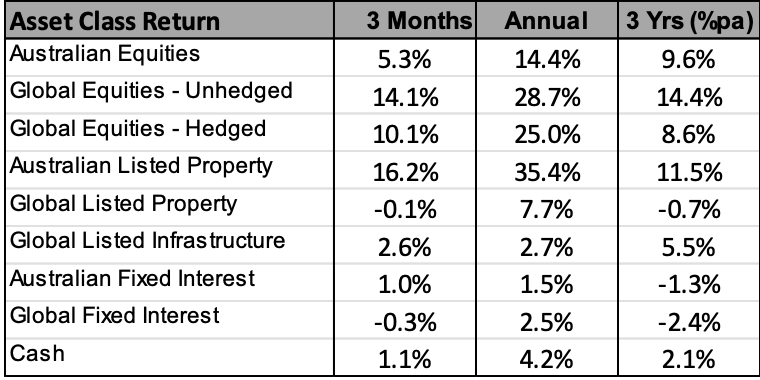

- Both global property and infrastructure significantly lagged the broader equity market.

Global Share Market Advance Continues

In a turnaround from recent months, there was a sharp bounce higher on the Chinese market over February and March, with Chinese shares 4.4% higher for the quarter. Both the share market and the broader Chinese economy may have now passed the bottom of recent downturns, and the relatively cheap valuations on the Chinese equity market have been attracting some buying support. On an annual basis, the Chinese equity market remains in negative territory by 9.4%, with Hong Kong 15.7% lower. Outside of China, other emerging markets lagged the heady returns of developed markets last quarter. India (up 6.2%) and South Korea (up 5.2%) both underperformed the broader global average, as did Brazil (down 5.7%), which was impacted by the lower iron ore price. Taiwan, however, was an exception, with its technology orientation contributing to a 15.7% gain.

A small lift in longer term global interest rates over the first two months of the quarter detracted support for global property and infrastructure. In fact, global listed property finished the month in negative territory at -0.1%, with listed infrastructure mildly positive at 2.6%.

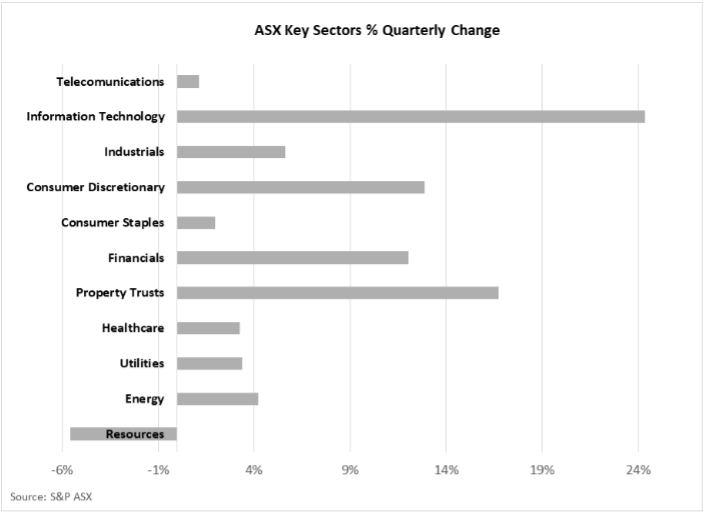

Although the March quarter continued to be dominated by technology and “growth” styled equities, there was some turn around in this trend in the final month of the quarter. During the month of March, the more “value” orientated sectors performed better, with property, resources and energy rallying. Smaller companies also outperformed larger companies in March, which was a reversal of the dominant trend of the past year.

Australian yields steady

There were some minor changes in monetary policy settings during the quarter, with the Swiss central bank lowering interest rates by 0.25% and the Bank of Japan increasing its policy rate to just above zero in March. However, policy settings in Australia and the United States remained unchanged. The Minutes of the Australian Reserve Bank’s March meeting did indicate a slight change in tone that possibly suggests a greater willingness to lower interest rates should inflation continue to decline.

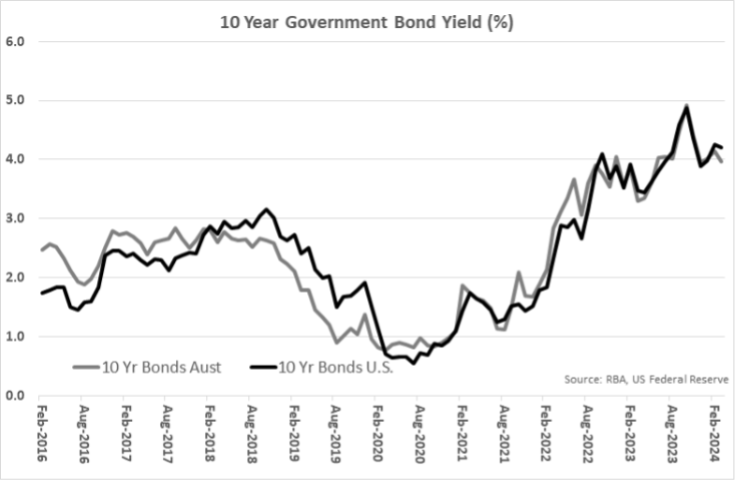

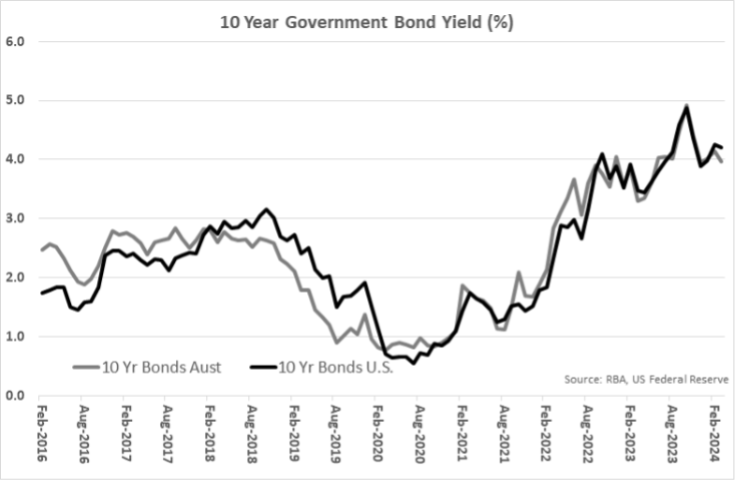

However, there was an increase in global longer term yields last quarter with the U.S. 10-year Treasury Bond yield moving from 3.88% to 4.21%. This increase is likely to reflect money markets pushing back expectations around the timing and magnitude of U.S. interest rate cuts because of some slightly higher inflation results in the United States. In contrast, the Australian 10-year government bond yield remained unchanged at 3.96%. The 0.25% margin between the U.S. and Australian 10-year yields is the largest recorded on a month end basis since October 2022 and is indicative of the weaker economic growth outlook for Australia.

After strengthening towards the end of 2023, the $A returned to a declining trend over the March quarter, falling from U.S. 68.4 cents to 65.3 cents. Weaker iron ore prices and a stronger $US contributed to the lower the lower $A. The $A was also 2.4% weaker against the Euro but moved 2.2% higher against a softening Japanese Yen.

Considerations for investors

A key feature of the equity market rally over recent months has been its narrowness. Technology stocks inside the U.S. S&P 100 Index gained 31.6% since the start of November and are nearly 50% ahead for the past year. This is approximately double the annual gain in the global equity market as a whole. No doubt some of this disproportionate increase can be explained by the favourable profit results announced by companies in this sector, and the fact that many are well positioned to benefit from AI. However, history does suggest that financial markets can “over extrapolate” new information and operate with “irrational exuberance”. Only time will tell whether or not now is one of those occasions.

Given the valuation risks that have potentially emerged in the technology sector, the change in the pattern of price growth evident in the final month of the March quarter was welcome. Areas of the market that had been ignored for much of the past year, such as infrastructure, smaller companies and property (where Goodman has been one of the few property companies globally to attract any positive sentiment) showed strong buying support and outperformance. This more balanced pattern of price movement, though, could be a sign that the equity rally is reaching a mature phase of the cycle whereby investors are being forced to look wide and hard for the remaining pockets of value.

The following indexes are used to report asset class performance: ASX S&P 200 Index, MSCI World Index ex Australia net AUD TR (composite of 50% hedged and 50% unhedged), FTSE EPRA/NAREIT Developed REITs Index Net TRI AUD Hedged, Bloomberg AusBond Composite 0 Yr Index, Barclays Global Aggregate ($A Hedged), Bloomberg AusBond Bank Bill Index, S&P ASX 300 A-REIT (Sector) TR Index AUD, S&P Global Infrastructure NR Index (AUD Hedged).

This Market Update contains information that is general in nature. It does not constitute financial or investment advice. Any information, material or commentary is intended to provide general information only. Zone Financial Pty Ltd makes no representation as to the accuracy or completeness of the information. Before acting on any information contained on this website, each person should consider its appropriateness having regard to their own or their clients’ individual objectives, financial situation and needs. You should obtain independent taxation, financial and legal advice relating to this information and consider it carefully before making any decision or recommendation.

Zone Financial Pty Ltd ABN 51 604 835 921, AFSL 544 310.

Further reading

Zone Financial

We are a strategic wealth advisory for forward thinking individuals and families, supporting them to use their wealth with intention and purpose to create the life and legacy they choose.

Quick links

Contact details

© Zone Financial 2023 | AFSL 544 310 | ABN 51 604 835 921

Financial Services Guide | Terms & Conditions | Privacy Policy | Complaints and Disclaimers